Is Credit Karma or Credit Sesame more accurate?

A good credit score can help you purchase the home of your dreams, qualify for a vehicle loan, and guarantee that you can pay your expenses even when times are tough. Credit monitoring services keep a close eye on your credit report and promptly notify you of any suspicious activity. Let us now learn more about credit monitoring.

What is Credit Monitoring?

Tools for credit monitoring keep track of your credit report and notify you of any alterations, inquiries, or new accounts. These actions assist in preventing fraud. The lender does a credit check when you are applying for a new credit card, vehicle loan, or mortgage to discover if you have a record of repaying your bills. A high credit score makes it easier for you to obtain loans, but it also makes you a more desirable target for thieves. What’s worse is that obtaining the personal data thieves require to steal your identity is now simpler than ever. After a data leak, they can try to contact you with a phishing email or just buy your personal information on the Dark Web. Any credit activity is alerted to you via credit monitoring, often within a few hours and even perhaps sooner if you are using a good and reliable credit monitoring service. The credit monitoring services keep tabs on your credit reports through Experian, Equifax, and TransUnion—the three main credit bureaus. Being informed of questionable behavior on your credit report is the major advantage of credit monitoring. The credit report will include a variety of details, including all open credit accounts, loans, and the balance owed on each. When you apply for a loan or credit card, a hard credit inquiry is made, which is a search of your credit report. History of payments, including any late or missing payments along with any recent or historical bankruptcy filings made public is some of the things that credit reports will include. Read on to know more about whether it is credit karma or credit sesame more accurate.

How can you Monitor?

By regularly reviewing your credit report, you may actively participate in keeping track of your credit score. You are typically entitled to one free credit report from all of the main credit agencies, but until the end of 2023, you may obtain a free report from each bureau every week. Additionally, you may get a free credit score from a variety of sources, most likely from a bank or other financial institution that you already use. A rapid shift in your score will indicate that you might need to verify your credit file, even though this information won’t help you to look for particular errors in your credit report. The issue with this tactic is the delay between a credit-related event and your notification of it. Furthermore, if you rely on your credit score to flag any issues, you won’t find out about a problem until it’s too late. Services for credit monitoring can fill this gap. This article will focus on these services and will answer whether it is credit karma or credit sesame more accurate.

Who needs Monitoring the most?

However, certain groups are more vulnerable than others. These consist of:

Young Adults: Young adults are more than twice as likely as everyone else to lose money to fraud. Senior Citizens: One of the most frequent victims of identity theft is the elderly. Children: Social Security numbers (SSNs) are instantly given to newborn children. One of the few strategies for preventing kid identity theft is credit monitoring. Previous Victims of Identity Theft: Everyone whose personal information has been compromised should keep an eye on their credit.

Therefore, one can say that these people need credit monitoring the most, to avoid any fraudulent activities affecting one’s credit scores and performance.

What is a Credit Monitoring Service?

A credit monitoring service is a business that will check your credit reports and notify you when any of the accounts listed on them change. Services often send you an email, text, or phone call when there are changes to your accounts. Between one service provider to another, prices and offerings might differ significantly. There are also several free credit monitoring services available for those who want to monitor their account without paying heavy charges. Fewer features are often included with free credit monitoring services than with premium alternatives. However, customers who want to actively monitor their credit reports while depending on the platform for warnings and monthly score updates can still benefit from a free service. Keeping an eye on your overall credit score can be advantageous, whether you’ve experienced identity theft or are getting ready to apply for a brand-new credit account. By sending you warnings when your credit profile is changed and keeping an eye out for signals of fraud and theft on the dark web and in your bank accounts, credit monitoring solutions make it simpler to keep track of your score and defend yourself against identity theft.

Should you Pay for the Services?

Similar to checking your checkbook and reviewing credit card bills, monitoring your credit is a wise financial habit. As long as you pay attention, free sites like Credit Karma and Credit Sesame provide you with the information you need to spot errors on your credit file. That amount of monitoring ought to be adequate if you don’t have any serious worries about the security of your personal information. If your personal information has previously been hacked, paying for credit monitoring (combined with further monitoring and protection against identity theft) is more appealing. Start with a free version to become familiar with the credit report and see if it meets your monitoring needs if you are unsure of the amount of protection you desire. If you are dissatisfied with the complimentary services, you can always move to a paid service. Read more to know, is credit karma or credit sesame more accurate in terms of free credit monitoring services. Also Read: Truebill vs Mint: A Detailed Comparison

About Credit Karma

Credit Karma is an online business that was established in 2007. It offers customers free credit monitoring as well as access to their Transunion and Experian credit reports and ratings. The best thing about Credit Karma is that all registered customers may utilize their services without paying a dime. They provide services to over 75 million customers, who also benefit from extra features including tailored loan and credit card product suggestions, loan calculators, and even tax filing services. Credit Karma is a great tool for anyone seeking a cheap and dependable approach to monitor their credit and raise their credit score.

Tools Used

Members of Credit Karma get immediate access to their Equifax and TransUnion credit reports, which are updated weekly. Consumers should remember that Credit Karma uses the Vantage Score 3.0 model, not the FICO credit scoring model used by the majority of lenders. This means that the information they provide is only meant to be used for educational purposes. Customers who are aware of what to anticipate from Credit Karma as a free financial resource will discover that it offers useful tools, insightful information, and relevant recommendations, which are especially helpful for people wanting to repair their credit.

Pricing

Since Credit Karma partners with financial institutions that provide credit cards and a range of personal loan products, all of its services are offered without charge. Only when users sign up for the loan and credit products that are suggested to them according to their credit profiles does the firm gets payment. read on to know more about whether it is credit karma or credit sesame more accurate.

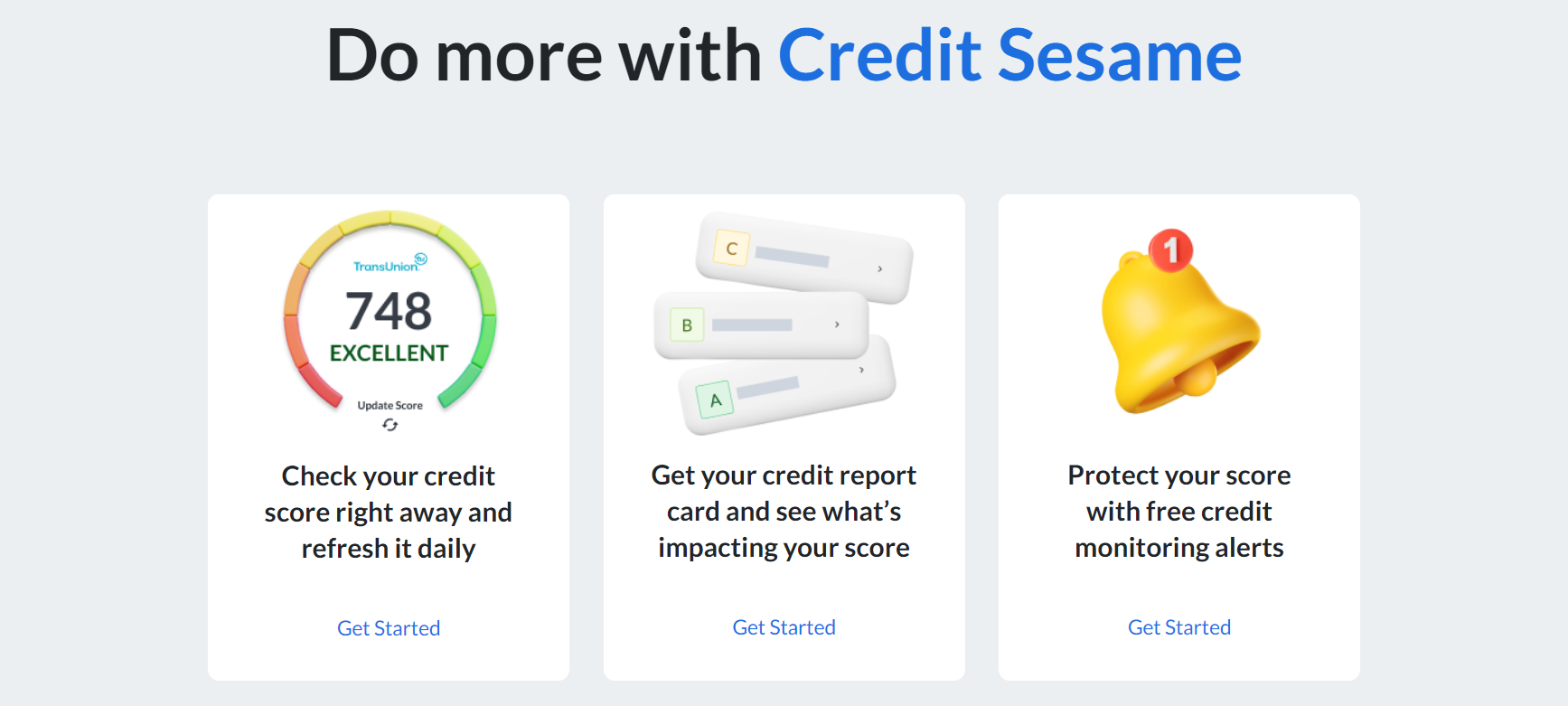

About Credit Sesame

Credit Sesame is a full-service debt and financial management platform with its corporate headquarters in Mountain View, California. It was founded in 2010 and provides consumers with free credit monitoring, free credit reporting, identity theft protection, and savings advice. It also provides financial counseling, credit score analysis, identity theft insurance, and restoration assistance—all without requesting credit card information. Anyone trying to establish, maintain, or improve their credit may gain from Credit Sesame’s services. In particular, their free identity theft protection for up to $50,000 is a fantastic perk for a membership that costs nothing and only needs a few basic identifying information to join up. Additionally, the business offers affordable paid membership services, tailored loans, credit card offers, and trustworthy counsel with insights based on your unique financial profile.

Tools Used

Based on a study of your TransUnion credit report, Credit Sesame’s free membership includes customized credit reports, monthly score updates, and credit monitoring. It must be emphasized that although having five parts that detail your payment history, credit use, credit age, account mix, and credit inquiries, these report cards are very different from a credit report.

Pricing

Credit Sesame provides free services such as credit monitoring and identity theft protection with up to $50,000 in insurance, as was previously mentioned. In addition, they offer premium paid services, with the advanced credit plan costing $9.95 per month. The Advanced plan includes monitoring from across all three major credit bureaus and daily score updates through one credit bureau. They also provide platinum protection plans for $15.95 per month and a pro credit plan for $12.95 per month. Also Read: Does Costco take Mastercard? All Payment Methods

Credit Karma vs Credit Sesame

Many people tend to have questions like whether it is credit karma or credit sesame more accurate or which platform provides better features. Here is a comparison table for a better understanding.

Why are Credit Karma and Credit Sesame Scores Different?

To now, is credit sesame better than credit karma, the best thing is to compare the accuracy of credit scores by both service. Many have noticed that both platform provide different scores. Well, the credit scores calculated by credit karma and credit sesame are different for a variety of reasons. This is mostly due to two causes: For starters, both companies get your credit report from various credit bureaus, including Experian, Equifax, and TransUnion. Karma draws its data from Equifax and Transunion, while sesame uses all three. Since different credit bureaus don’t receive the very same information about the credit accounts, your score may vary depending on which bureau the credit report is taken from. Secondly, both organizations use various credit score models (and versions) across the board. Hopefully, this will answer the question of, is credit karma or credit sesame more accurate.

About WalletHub

WalletHub provides credit monitoring services to all applicants without charge. As a result, you don’t need to be concerned about the expense. Additionally, this credit score is constantly updated, allowing you to track even the smallest adjustments. Credit bureaus don’t update credit scores every day, therefore the phrase ‘the-fastest-updating credit monitoring service’ is probably more accurate. WalletHub will obtain your credit report from TransUnion for free when you request one. The VantageScore 3.0 model for this report is used. The only website that summarizes credit reports into a timeline is WalletHub. You can more easily keep tabs on changes to your credit score in this way. Read further to know, is WalletHub better than credit karma.

WalletHub vs Credit Karma

Here is a comparison table between Wallet Hub and Credit Karma. Perfect and user-friendly credit score simulators include Credit Karma and Wallet Hub. They allow you to understand how certain prospective actions—such as debt repayment, missed payments, opening new accounts, etc.—might influence your credit score. Wallet Hub refreshes the scores every day, whereas Credit Karma changes them once a week. While the Wallet Hub has one of the slickest interfaces, Credit Karma’s may occasionally be fairly difficult to navigate. Overall, both platforms are useful. However, one will have to pay attention to the monitoring tools and one’s objectives before choosing one. This article focuses on is credit karma or credit sesame more accurate in terms of credit monitoring. Also Read: Why is AliExpress so Cheap? Is it worth it?

Choosing a Free Credit Monitoring Service

You must have noticed, why are credit karma and credit sesame scores different. Well, in reality most of the services are different from each other. You can evaluate credit monitoring services with the aid of an understanding of your priorities, credit history, and security requirements. To assist you in selecting the service that’s best for you, take into account the following elements.

Credit Monitoring Alerts: Low-cost or free services often notify you when your credit score changes, new credit inquiries are made, or applications for additional credit lines are submitted. Security features including warnings if your personally identifiable information (PII) is discovered in public records, the dark web, or social networks are included in more costly subscriptions. Several Credit Bureaus Checked: Although some credit monitoring solutions only check only one credit bureau, by monitoring all three agencies and being familiar with how to check the credit report, you’ll gain a full view of the activity taking place on your credit file. Security Features: If you have children or have experienced identity theft, you may want to think about plans with more security measures. Dark web surveillance, financial account monitoring, and identity theft insurance are all available in many low-cost plans. Social networks, cyber bully, and sex offender monitoring may be included in family planning. Score Model: FICO Score and VantageScore are the most used scoring methods for credit. Consider a plan that gives you access to your FICO score if your objective is to raise your credit score to obtain a loan or make a home purchase. Learn how to check your credit score. Cost: Plans cost anything from nothing to $50 per month. Basic monitoring reports and warnings are included in free plans for one or two bureaus. A number of security features, including device protection, the dark web, and social network monitoring, are typically included in the more expensive subscriptions.

So, there you have it, a clear comparison to judge, whether it is credit karma or credit sesame more accurate. Although Credit Sesame provides premium membership tiers that charge every month for some features, neither website requires a credit card to sign up. They provide users with suggestions for credit cards, loans, and insurance based on an algorithm based on credit history and income.