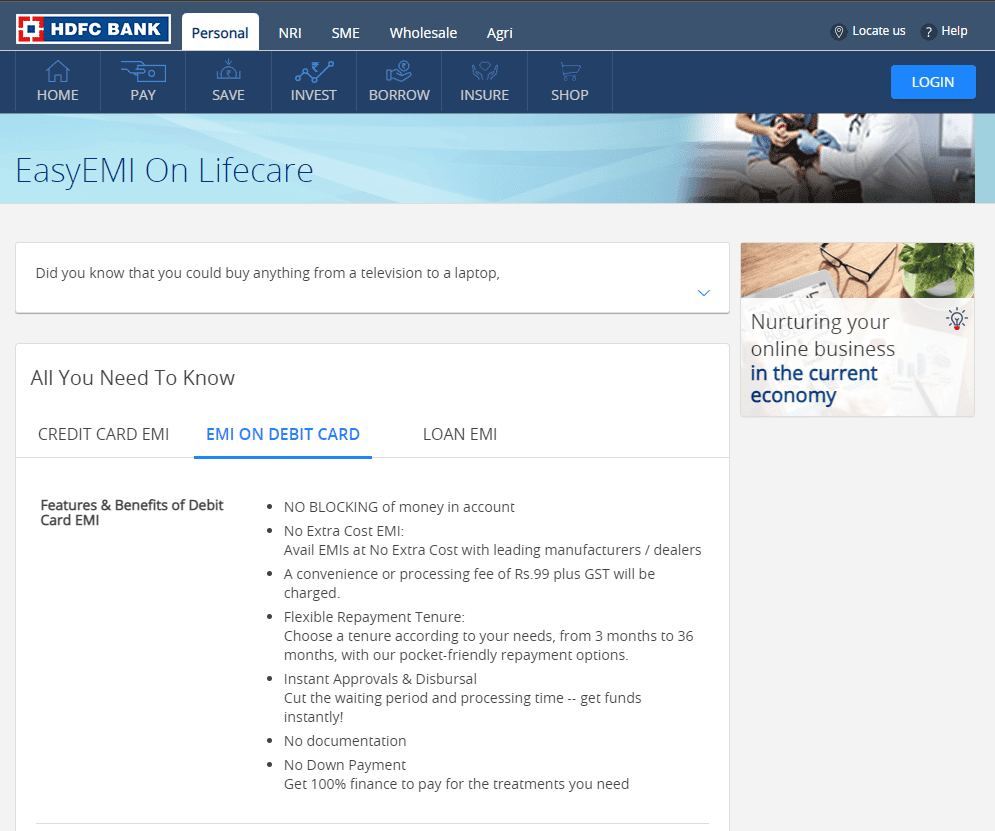

HDFC Debit Card EMI Eligibility Check Process

Credit cards, loans or any other borrowing brings with it a high rate of interest and a few other stipulations, but with an EMI you know beforehand the sum that you will be paying back each month for a fixed term, till you wipe out all the scheduled payments. Let us continue to learn more about EMI before moving to its eligibility check.

What is EMI?

As introduced above, EMI makes you feel that the borrowed sum or the credit amount owed by you is comparatively less than what it should be like. EMI stands for Equated Monthly Installments. Let’s say you purchase a music system worth 12,000 rupees. Now, these 12,000 rupees if you had to give them away in one installment the burden of payment on you would be too much, however, if you get 12 months and need to pay 1,000 rupees a month plus some interest amount then wouldn’t it be easy. In short, for a bit of added rate of interest, you get to break your large chunk of payment into smaller and easily payable chunks. And since you know the amount payable in advance each time, you can also make prior arrangements to make sure you have the installment money with you before time.

Ways to check HDFC Debit Card EMI Eligibility

As we made clear earlier, EMI cannot be availed by anyone and everyone just about randomly. There is a way to go about getting an EMI, you need to first check if you are eligible or not to get an EMI. Here we will mention the ways by which an HDFC Debit card holder can check if or not they are eligible to get an EMI. HDFC Debit card EMI Eligibility check can be done in the following ways:

Using Whatsapp

If you want to check your eligibility using WhatsApp, then all you need to do is text ‘DCEMI’ to 7070022222.

Using EVA Chatbot

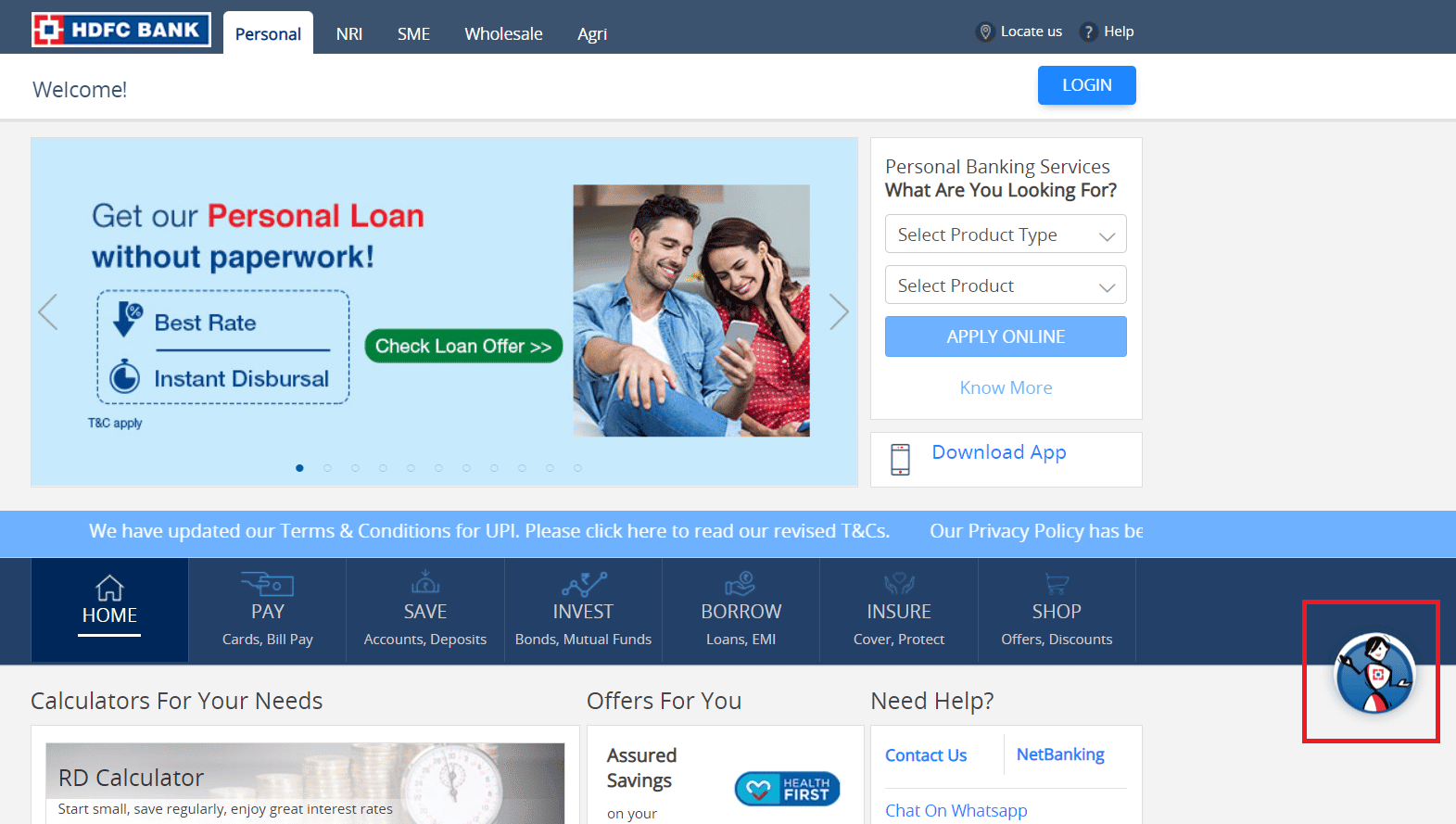

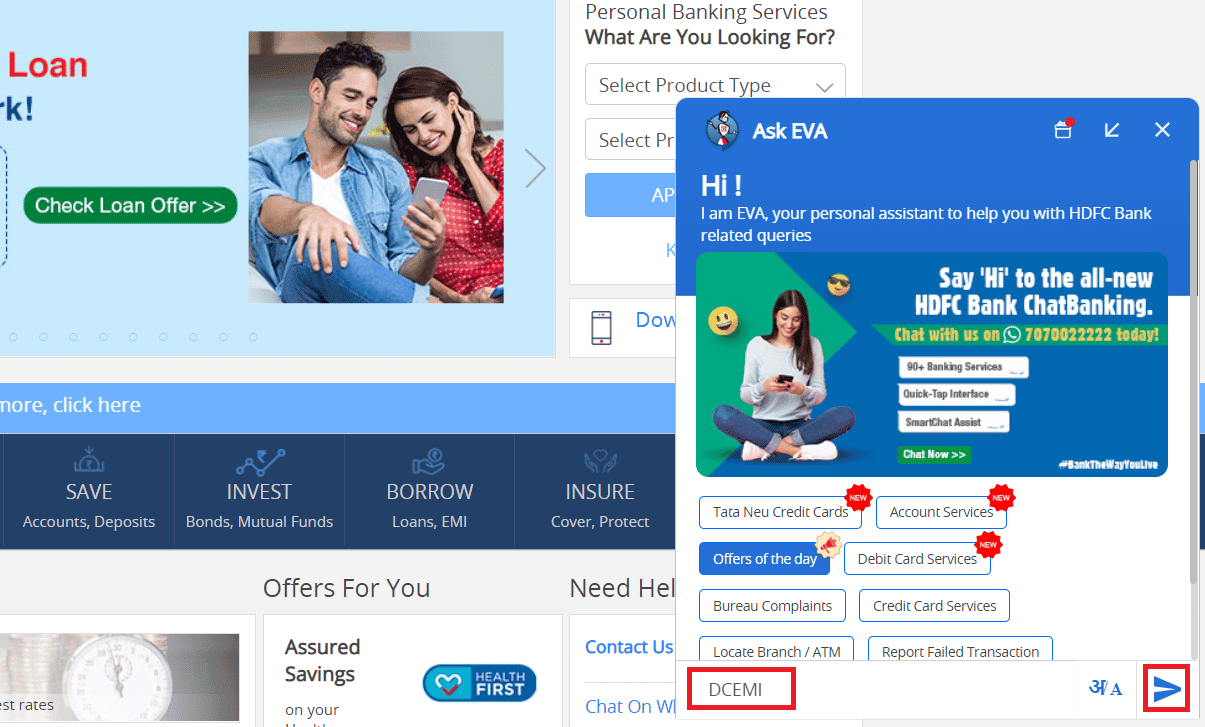

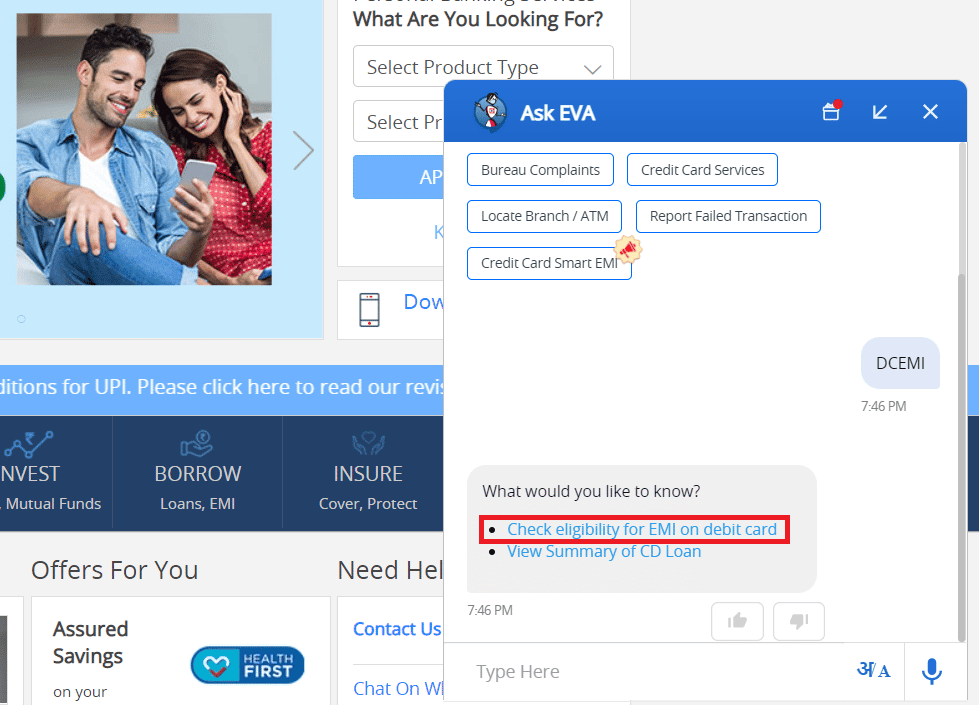

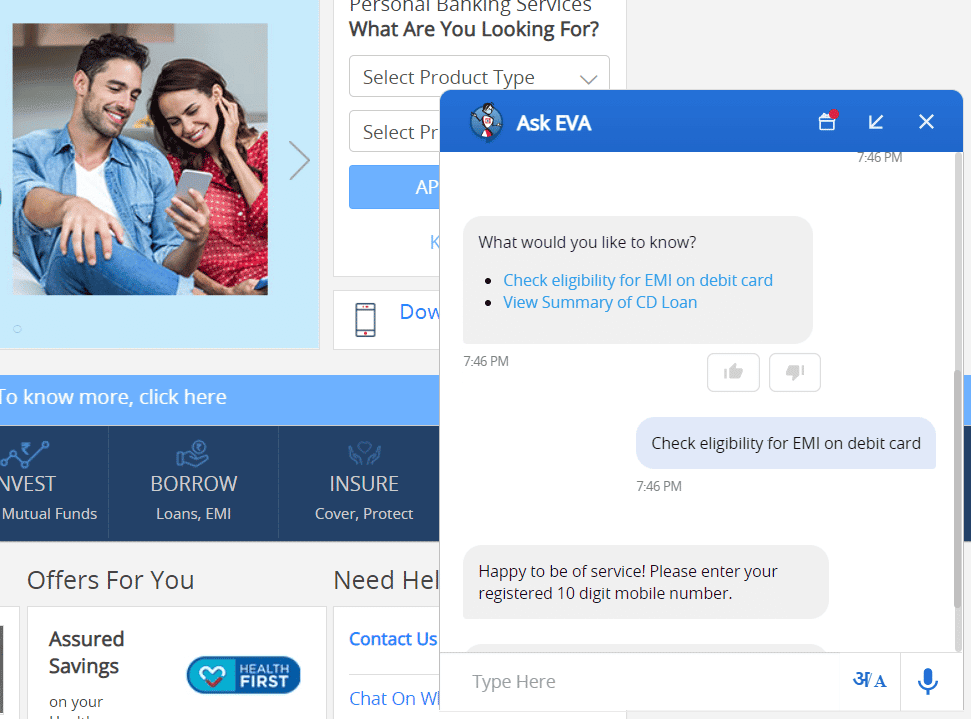

You can also use the chatbot provided by HDFC to check your eligibility. Follow these steps:

Go to HDFC Bank official site.

Click on EVA chatbot pop-up in the bottom right corner.

In the chatbot, type ‘DCEMI‘ and click on send icon.

You will receive a message with two options. Click on ‘Check eligibility for EMI on debit card‘

You will now be asked to enter your registered mobile number. After entering the number and clicking on send icon, you will get an OTP.

Enter the OTP and click on send icon again. You will be shown your eligibility status in the next message.

Using SMS

If you prefer using SMS then you need to send an SMS to 5676712 which reads MYHDFC.

Using Call

You can also perform HDFC Debit card EMI eligibility check by giving a miss call to 9643222222.

How to check Debit Card EMI Eligibility

Above we have mentioned how to check Debit card EMI eligibility for HDFC Bank. However, the process to check for eligibility of the debit card of any and every bank is almost the same. Each bank has its own number where you can message or send a missed call and receive the necessary information. One other way of checking eligibility for EMI would be to go on some e-commerce websites and add items to your cart. Now, if you are paying via Debit card and the EMI option is available to you then you know that you are eligible, similarly if the option is not shown to you then you must know that you are not eligible for an EMI.

How to check HDFC Debit Card EMI Statement

Not everyone gets the EMI facility and so not everyone knows how to check HDFC debit card EMI statements. If you are one of those lucky customers that is eligible for an EMI facility and have availed its benefit then we will help you learn how you too can check your EMI statement right from the comfort of your home. For being able to check your statement you need to use your registered email ID because that is where you will receive your emails. So now that you have your registered email account, you already have access to the place where you are monthly sent updates on your EMI loan. The bank sends out an email monthly that has a PDF containing the details that you are looking for. All you have to do is open your email account and login and search for HDFC Bank or whatever bank that you have signed up with. The emails should show up in your inbox. Open the email from your bank and check for a PDF at the bottom of it. Now download these PDFs and you will have what you are looking for.

HDFC Debit Card EMI Eligibility Check Number

Be it checking your credit score or checking your eligibility for a loan, getting such things checked is always a long and arduous process and there is documentation, a lot of back and forth, and other stuff involved in all this, however, when it comes to checking EMI eligibility, the process could not have been any simpler than it is. No matter what bank you are dealing with, the process of getting your eligibility for EMI checked is very simple and it can be done on your phone even from the toilet seat of your home. All you need to know is that there are a few numbers that your respective banks have for checking EMI eligibility. Using these numbers you can either send a text or a missed call to your bank and you will get details of your status. The HDFC Debit card eligibility check number for WhatsApp users is 7070022222. For any person who prefers to send an SMS the necessary number is 5676712 and lastly if you are someone who wishes to get to know their eligibility via a missed call then the number they need to know is 9643222222. Let us now learn about HDFC Debit Card EMI Mobile.

HDFC Debit Card EMI Mobile

HDFC Debit card EMI mobile purchase is very easy. Simply follow these steps:

As a customer, all you have to do is head to any e-commerce website or the website of any partner brand of your bank. There you select the mobile that you need to purchase and proceed to make payments. Now if you are an eligible customer for EMI then you get the EMI option to make payment for your purchase. Here, you select the EMI option and make the payment for the first installment depending on the amount and the time period of the loan. From now on monthly, you make a fixed payment on a fixed date as mentioned in the terms and conditions until you have cleared the amount owed to you. In case, you wish to go for offline purchase, then you can let the billing counter operator know about opting for the EMI facility. On the acceptance of your request, pay the first down payment and follow a similar procedure of making monthly installments.

HDFC Debit Card EMI Limit

The HDFC debit card EMI limit is 5 lakh rupees. The card has a processing fee of 199 rupees plus GST. Late payment of installments brings in an additional charge and the interest rate charged for the debit card is as per the terms and conditions. The minimum amount that can be borrowed using an HDFC debit card is 5,000 rupees and the tenure for taking out such an amount is from 3 months to 36 months.

Should you choose EMI or not?

To make this decision you should take a look at the pros and cons of EMI. Using these pros and cons, you can understand better if EMI is for you or not.

Pros

EMI makes things affordable for you. In today’s time when everything is pricey and expensive, fulfilling wishes can get tougher and this is where an EMI steps in and helps you. Be it a home, a car, or any huge item that you are looking to purchase, the burden of payment gets divided from one huge chunk to many smaller chunks. Since your payments are now monthly installments and the burden of payment is less on you, you can now invest money elsewhere as well and still have money left to fulfill your other demands. When it comes to EMIs you can plan your payments in advance and that helps you manage your finance. Paying for EMI is now even more flexible than before and you get to decide your own terms and which makes life easier for you as a borrower. Only two parties are involved in the lending and borrowing and so the process is less complicated than one expects it to be.

Cons

The duration of your loan gets stretched and the time period gets extended. The final amount that you pay to get an object ends up being more than the original amount that you would have paid. The rate of interest and other charges take up the amount of your purchase. You can’t even repay EMI before the due date because again you are being charged 2 or 3 percent for the same making it a less attractive option. Defaulting on EMI payments can lead to your mortgaged property being liable to be taken over by the lender. Defaulting on an EMI can badly affect your credit score and that can create a problem for you in the future when looking to take loans. EMIs also bring a processing fee which makes taking them ever pricier.

We hope you are now familiar with HDFC Debit card EMI eligibility check process. We also provided you details on how to check debit card EMI eligibility, how to check HDFC Debit card EMI statement, HDFC Debit card EMI eligibility check number, HDFC Debit card EMI mobile and HDFC Debit card EMI limit. You now know that checking your eligibility for EMI on a debit card is that easy, you can get started and check your eligibility and start purchasing using EMI options now. Make sure to borrow amounts that you are capable of repaying and make sure to make timely payments.