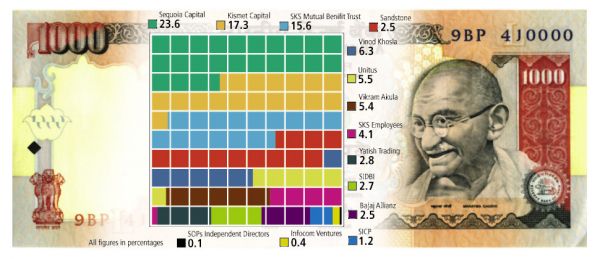

SKS Shareholding and Investors

On a rainy afternoon at a five-star hotel in suburban Mumbai, Vikram Akula is making a fervent pitch to a group of potential investors in the enterprise he founded, SKS Microfinance (SKS). Akula and SKS chief executive Suresh Gurumani take turns at the mike to impress on the rainmakers the advantages of investing in SKS, well on its way to becoming the world’s biggest micro-lender. While their purpose is the same, the two men present a study in contrast. Akula, resplendent in his red kurta-pajama, stands out against the dark-suited, ex-Barclays banker. While Akula tugs at the heart with his passion for the rural poor, Gurumani guns for the mind with staccato beats on operating margins, market share, and return on equity. On the stage, however, their rhythm is flawless. They tell the story of how SKS grew from a small not-for-profit with a mere 2,000 borrowers in 2001 to a vibrant company with 4.7 million customers in 19 states, a disbursement record of $1.8 billion, and an outstanding loan book of $554 million. By any yardstick, these are impressive statistics. Given that 90 percent of India’s 3,150 microfinance institutions have fewer than 10,000 customers each, this sort of scaling up is an investor’s dream. More importantly, SKS was one of the first to show that private capital could be harnessed to nurture sustainable livelihoods in villages. The company raised $153 million in equity capital along the way — a decisive show of harmony between the idealistic vision of Akula and the profit pragmatism of Gurumani. Back at SKS, however, the two are not playing quite the same tune. The pressure from commercial capital for profit-linked growth is mounting and Akula must fight to save the social objective for which he founded SKS. The conflicts are now testing the very model of serving the poor through tiny loans and freeing them from the hold of loan sharks. “In my view, SKS right now is trying to reconcile its split identity and re-architect what the company stands for,” says Anna Somos Krishnan, a former SKS executive and now executive director of Planet Finance India, an international NGO for the development of microfinance. SKS, like the sector it represents, is at a crossroads today. The company is working to become the world’s largest microfinance institution (MFI) next year by overtaking Muhammad Yunus’ Grameen Bank with 8 million customers. SKS is also on the verge of becoming the first-ever MFI in India to go public: It could sell its shares in an initial public offer in the first quarter of 2010 and thus offer existing shareholders an opportunity to book profits. Internal conflicts couldn’t have come at a worse time. Not only is the management divided on how to grow, but is also facing charges of overstretching and ‘mission drift’ — of losing sight of its customers in favor of profitability and investor targets. Yunus, widely regarded as the father of microfinance, shivers at the thought of mixing private profits and microlending. “Of course MFIs can serve the poor and make a huge profit,” he tells Forbes India in an email interview. “But I would not support it. That’s what loan sharks have been doing over centuries. I don’t want to see a new version of loan sharks under the guise of MFI.” He will surely be reading the IPO prospectus. “In going for IPO, if SKS does not make it clear that they will make absolutely sure that their interest rate will not exceed 10 points over the cost of fund, I will get very worried. I don’t wish to see SKS following the Compartamos path,’’ Yunus says, referring to Mexico’s Banco Compartamos, whose similar model and 2007 IPO he criticized.

First Steps to Profit

What started as a small NGO called Swayam Krushi Sangam saw its big transformation to a profit-motivated MFI in 2004, interestingly, while the founder was away. That year, Akula had stepped down and joined consulting firm McKinsey in Chicago. By mid-2005, SKS had become a non-banking finance company with investors like Vinod Khosla and Small Industries Development Bank of India. The new investors wanted Akula back at the helm, driving the transition from non-profit to for-profit. “The investor group was going through its own education process. It was really a bet on Vikram and his years of experience in the field,’’ says Ashish Lakhanpal, managing director of Kismet Capital, the second-largest investor in SKS. Akula agreed to come back. His homecoming created microfinance history in India: Private investors pumped in $3 million into the company in March 2006. Vineet Rai, an old friend of Akula’s and the founder and CEO of social venture capital fund Aavishkaar, says, “The Vikram who went away was a soft-spoken almost naïve, nice human being. The one who returned from McKinsey was a clear visionary who knew how to build a large company. It’s the difference between saying ‘I want to go to the top of Mount Everest,’ vs. ‘I know exactly how to get there’.” The Akula who returned from the US was also a man in a hurry. The story goes that Akula hired full-time staff to fill out award applications on his behalf. Akula denies this saying his staff filled out only two applications while he has won several recognitions: Schwab Social Entrepreneur of the Year (India), Ernst & Young Start-Up Entrepreneur of the Year (India), Young Global Leader by the World Economic Forum to name a few. Media across the world loved him. He was featured on CNN, the front page of the Wall Street Journal, and TIME magazine’s list of the world’s 100 most influential people. BusinessWeek named SKS one of the top five emerging and influential companies in the world in 2009 along with social networking site Facebook and online community for classified ads Craigslist.